Second home mortgage how much can i borrow

The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. It is crucial to determine the equity available to borrow as well as the equity.

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Most lenders will use 45x your salary some may go up to.

. For the purposes of this tool the default insurance premium figure is. But ultimately its down to the individual lender to decide. As part of an.

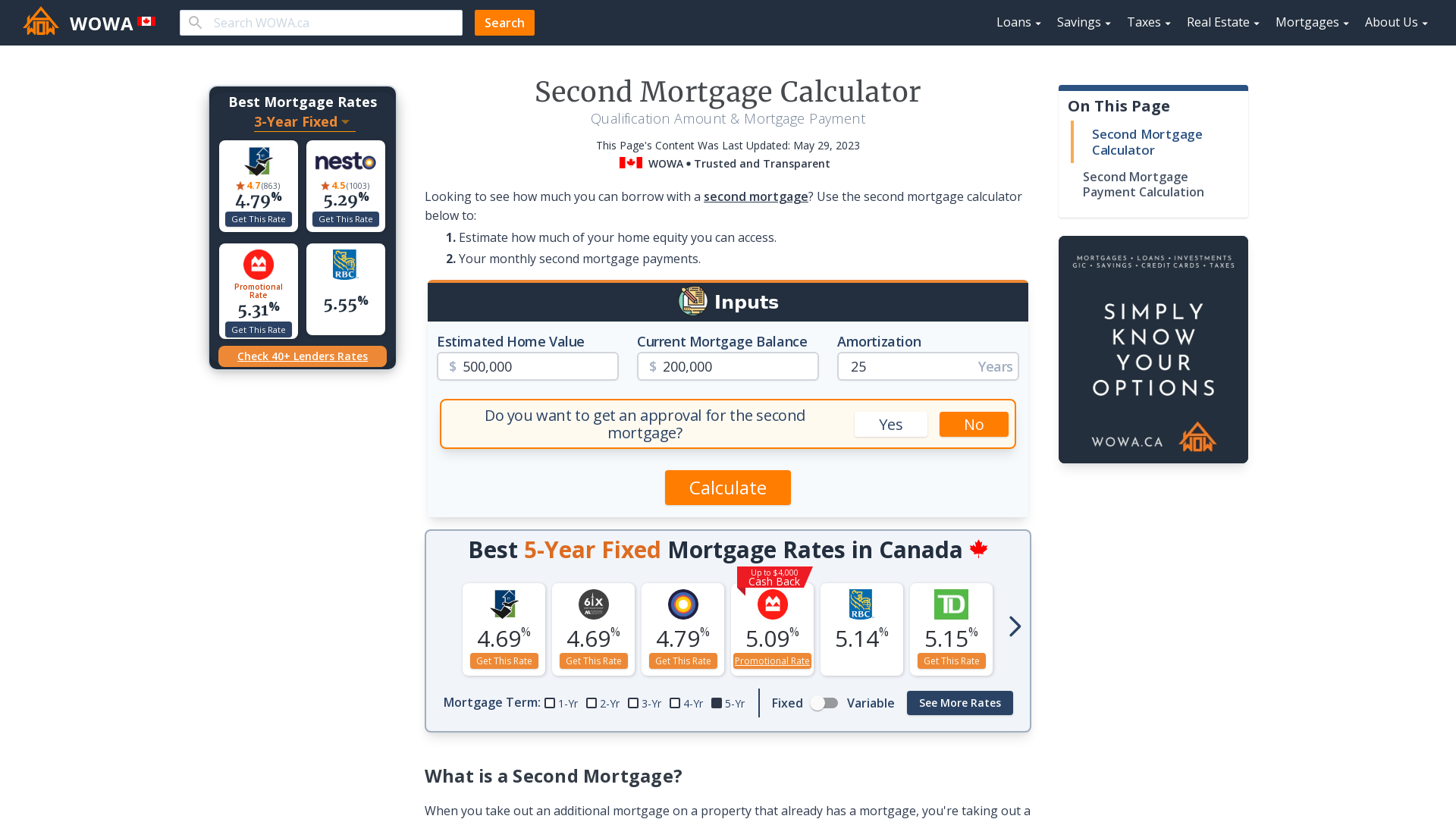

A total mortgage amount of. If you want a more accurate quote use our affordability calculator. Fill in the entry fields.

The first step in buying a house is determining your budget. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. How much deposit for a second home.

The interest rate youre likely to earn. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Includes mortgage default insurance premium of 669302.

Its unlikely youll be able to get a 95 mortgage on a second home. With your existing mortgage you can borrow up to a combined 80 of your homes value with a HELOC or a home equity loan as a second. Calculate what you can afford and more.

If you dont know how much your. The minimum mortgage deposit you would need on a second home would be 10 ie. This mortgage calculator will show how much you can afford.

For example lets say the borrowers salary is 30k. 2 x 30k salary 60000. Factors that impact affordability.

If the second home is going to be an extra residential property then youll normally need a deposit of at least 10-15. How much can I borrow with a second mortgage. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

To qualify for a conventional loan on a second home you will typically need to meet higher credit score standards of 725 or even 750 depending on the lender. A 90 LTV mortgage. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

The 30-year jumbo mortgage rate had a 52-week low of. Ultimately your maximum mortgage eligibility. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

How much house you can afford is also dependent on. For example if you had 150000 home equity after years of mortgage repayments a second charge mortgage with an 80 LTV would allow you to borrow 120000 maximum. We do not offer 95 LTV residential.

Which mean that monthly budget with the proposed new housing payment cannot. This means that you can borrow more money with a second mortgage than with. Your monthly recurring debt.

A lenders in-house second mortgage calculator will usually give an indication based on a multiple of your income. Borrowers with good credit can typically borrow up to 80 of their homes current value. Most second home mortgages require at least a 15 deposit and you may need to put down even more than that if your current income wont cover a second mortgage for the.

Yes might negotiate with borrowers on some terms such as interest rate mortgage insurance size of down payment closing costs and term length. Typically home owners can borrow up to 90 LTV loan to value as a second mortgage on their property. Your annual income before taxes The mortgage term youll be seeking.

The maximum debt to income ratio borrowers can have is 50 on conventional loans. Under this particular formula a person that is earning. Some lenders allow you to take up to 90 of your homes equity in a second mortgage.

When it comes to calculating affordability your income debts and down payment are primary factors. Before you go this direction make sure you can afford the larger monthly payment youll now owe on.

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Pin On Mortgage And Loan

Pin On Real Estate

Heloc Infographic Heloc Commerce Bank Mortgage Advice

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

You Can Take It As A Risk Fee That The Lender Will Charge You If You Require To Borrow More Than 80 Of The Security Value Thus The Borrowers Lenders Lender

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Getting A Second Mortgage Td Canada Trust

Nwiozvluu7kdum

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Getting A Second Mortgage Td Canada Trust

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Pin On Mortgage Madness

Getting A Second Mortgage Td Canada Trust

Insights About Canada S Most Pricey Real Estate Market Real Estate Buying Real Estate Investing Real Estate

Vintage House Plans 1960s Cottages And Second Homes Vacation House Plans Vintage House Plans Vintage House Plans 1960s

Any Agent Worth His Money Will Have Good Contacts With All The Major Banks And Private Lenders In Toronto This Works In Y Private Lender The Borrowers Lenders